Content Budgets Rise as Measurement Advances-Nearly Half of Marketers Are Spending 20% More on the Discipline

Kate Maddox summarizes the results of a new report on content marketing by Forrester Research in this Advertising Age article. According to the report’s author, Ryan Skinner, senior analyst at Forrester Research, marketers have increased their content marketing budgets and have been able to achieve bottom-line measurement of their content marketing programs.

Twenty-five percent of marketers increased their content marketing budgets by 30% or more in 2015 compared to 2014, and 47% of marketers boosted their content marketing budgets by 20% or more.

Skinner attributes the budget increases to:

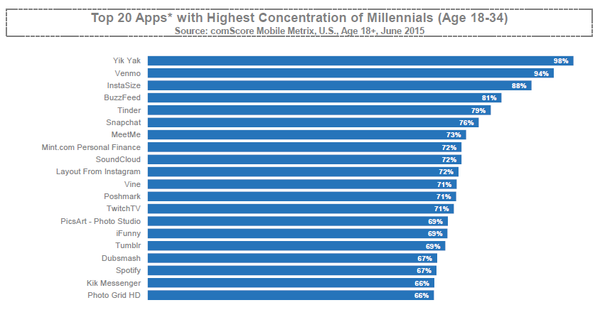

-The shift from traditional to online media, especially by millennials.

-The use of self-directed research by customers during the purchasing journey.

-The need for valuable, relevant content due to ad blocking.

In addition to increasing these budgets, there is an increased ability to measure the impact of content marketing.

Seventy-five percent of marketers reported positive bottom-line results from their content marketing, including increased customer loyalty, and reduced marketing and media expenses. In addition, 57% of marketers reported increased revenue and sales.

This article also presents the details of content marketing strategies by SAP and Lenovo. Metrics used by these companies to measure content marketing results include overall impressions and views, time spent engaging with the content, the number of leads generated and sales.

See all 5 Cups articles.